Many view the price of any cryptocurrency as a simple ebb and flow dictated solely by market sentiment or Bitcoin’s shadow. However, when delving into the nuances of XRP, this simplistic perspective falls critically short. The trajectory of XRP price is a complex tapestry woven from threads of regulatory battles, technological adoption, and its unique role in the global financial ecosystem. Understanding these intertwined elements is paramount for anyone seeking to grasp its potential.

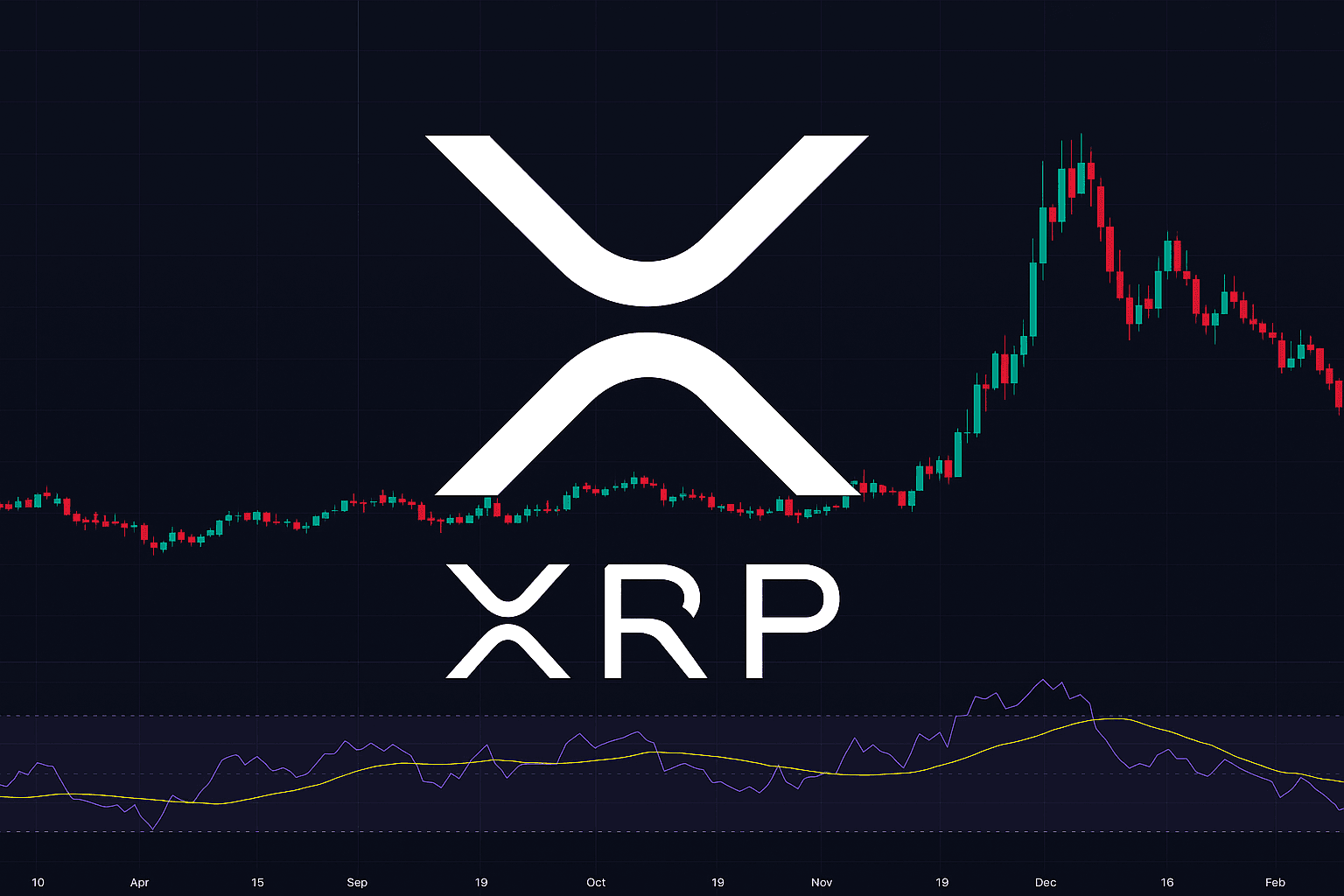

It’s often the dramatic headlines surrounding legal disputes that capture public attention, leading to volatile swings. Yet, beneath the surface, a more foundational set of factors are constantly at play, shaping XRP’s long-term value proposition. In my experience, focusing solely on short-term price action often leads to missed opportunities and a clouded understanding of the underlying asset.

The Ripple Effect: Regulatory Scrutiny and its Price Implications

Perhaps the most significant external force influencing XRP price has been the protracted legal battle with the U.S. Securities and Exchange Commission (SEC). This regulatory uncertainty has cast a long shadow, creating apprehension among institutional investors and limiting XRP’s accessibility on certain exchanges.

Impact on Accessibility: When major trading platforms delist or suspend XRP trading due to regulatory concerns, it naturally reduces demand and liquidity. This can put downward pressure on the xrp price.

Investor Confidence: Conversely, positive developments or favorable rulings in this legal saga have historically correlated with significant upward price movements. These moments signal a potential clearing of the regulatory fog, bolstering investor confidence.

Global Landscape: It’s crucial to remember that regulatory frameworks differ vastly across jurisdictions. While the U.S. situation has been a focal point, other countries have adopted different stances, influencing global adoption and, by extension, XRP’s price.

The market’s reaction to these regulatory updates often seems amplified, highlighting the sensitivity of the XRP price to such news. It’s a stark reminder of how external, non-technical factors can exert immense control over digital asset valuations.

Beyond Speculation: The Fundamental Value Proposition of XRP

While regulatory hurdles are undeniable, it’s vital to look at what makes XRP inherently valuable. Ripple, the company behind XRP, positions it as a bridge currency for cross-border payments, aiming to facilitate faster, cheaper, and more transparent international transactions.

#### Bridging the Gap: Cross-Border Payments and Utility

The core utility of XRP lies in its ability to act as a liquidity tool. Banks and financial institutions can use XRP to settle cross-border payments almost instantaneously, bypassing traditional correspondent banking networks, which are often slow and expensive.

Reduced Transaction Costs: By using XRP as a bridge, financial institutions can avoid holding large amounts of foreign currency, thereby reducing capital requirements and associated costs.

Speed and Efficiency: Traditional international payments can take several business days to clear. XRP transactions, on the other hand, settle in seconds, a significant improvement for time-sensitive transactions.

Network Effect: As more financial institutions adopt Ripple’s technology and utilize XRP for payments, the network effect strengthens, potentially increasing demand for XRP and, consequently, its price.

This underlying utility is a fundamental driver that, in the long run, could significantly impact the xrp price. The more tangible the use case becomes, the more resilient its value proposition will be.

Technological Advancements and Network Health

The underlying technology powering XRP, the XRP Ledger, is also a critical factor. Its efficiency, security, and scalability directly contribute to XRP’s attractiveness as a digital asset.

#### The XRP Ledger: Innovation and Scalability

The XRP Ledger is a distributed, decentralized blockchain technology that boasts high transaction speeds and low transaction costs. Its consensus mechanism, known as the XRP Ledger Consensus Protocol, allows for rapid transaction validation without the energy-intensive mining processes seen in other cryptocurrencies.

Transaction Throughput: The ledger’s ability to handle a high volume of transactions per second is crucial for its adoption by financial institutions dealing with significant transaction flows.

Ongoing Development: Continuous upgrades and development by Ripple and the broader XRP community enhance the ledger’s capabilities, security, and interoperability. Innovations like the XLS-20 standard, which enables native NFT functionality, demonstrate a commitment to expanding its use cases.

Security Features: The decentralized nature and robust consensus mechanism of the XRP Ledger contribute to its security, a non-negotiable for financial applications.

These technological underpinnings are not just abstract concepts; they directly translate into the perceived reliability and efficiency of XRP, influencing investor decisions and, therefore, its price.

Market Sentiment and Broader Crypto Trends

Like all cryptocurrencies, XRP is not immune to the broader market sentiment within the digital asset space. Bitcoin’s price movements, major news events affecting the crypto industry, and shifts in investor risk appetite can all influence XRP.

Correlation with Bitcoin: Historically, XRP has often shown a correlation with Bitcoin’s price action, especially during significant market rallies or downturns. While it can sometimes diverge, Bitcoin’s dominance means its movements often set the tone for the entire market.

Institutional Adoption: The overall trend of institutional adoption in the cryptocurrency space can create a positive environment for assets like XRP, provided regulatory clarity improves.

Speculative Interest: While utility is key, speculative interest also plays a role. Periods of high trading volume and social media buzz can lead to short-term price spikes, irrespective of fundamental developments. It’s interesting to note how quickly sentiment can shift in this volatile asset class.

Charting the Future: Factors to Watch

Looking ahead, several key factors will continue to shape the xrp price. The resolution of the SEC lawsuit remains paramount. A definitive, favorable outcome would likely unlock significant institutional interest and broader market participation.

Furthermore, the pace of adoption of Ripple’s payment solutions by financial institutions will be a critical indicator of XRP’s real-world utility. Demonstrable success in facilitating cross-border payments will build long-term value.

Finally, continued innovation on the XRP Ledger and the broader evolution of the digital asset landscape will also play their part. The ability of XRP to adapt and integrate with emerging technologies will be crucial for its sustained relevance.

Final Thoughts

The journey of XRP has been a compelling case study in the multifaceted nature of cryptocurrency valuation. Beyond the daily price charts, a deep dive reveals a confluence of regulatory pressures, fundamental utility as a bridge currency, robust technological development, and the pervasive influence of broader market sentiment. For those keen on understanding the forces that move XRP, looking beyond the immediate headlines and appreciating these underlying dynamics is not just beneficial, it’s essential for informed decision-making. The future trajectory hinges on the successful navigation of these complex currents.